National Real Estate Review Board

Tips for Buyers

Buying A Home

A home purchase may be your largest financial transaction to date, so it’s important to make the right decisions and to keep an eye on the details. With the assistance of your Real Estate Agent and Loan Officer, it should be an efficient, pleasant, and ultimately rewarding experience.

As you prepare to look for homes, make sure that you know how much you can comfortably afford. You want to know how your credit and the type of mortgage you choose can affect your monthly payments and overall cost of the loan.

Budget

You may qualify for a higher amount than you actually want to pay. It’s important to not only check with a mortgage agent to get pre-approved, but to know what the payments will be at that amount. Remember to factor in homeowner’s insurance, property taxes, utility bills, moving costs & maintenance. Learn More

Check your credit

When preparing to buy a home, one of the most important steps is understanding and improving your credit. Your credit history and score directly impact your ability to qualify for a mortgage—and what interest rate you’ll receive. Your credit report is a detailed record of your borrowing history. It reflects how responsibly you’ve managed money over time.

If there are any discrepancies, work with the credit reporting agency to have those cleared up before you inquire about a loan. Learn More

Get pre-approved

After determining what you can afford and reviewing your credit you will want to contact your local bank or mortgage company to get pre-approved for your loan before you start looking for a house.

Among the items you should have: Good credit, stable employment history, a positive debt-to-income ratio and document of your assets.

Choose The Right Agent

Choosing a knowledgeable, customer-focused local Real Estate Agent is one of the most important decisions you’ll make in your home-buying journey. A great agent will advocate for your best interests, save you time, and help you avoid costly mistakes.

Involve your agent right from the start to ensure you’re making smart, informed decisions from day one. Working with a skilled local agent ensures you stay focused, confident, and competitive in your search.

What Your NRRB Verified™ Agent Will Do for You:

Clarify Your Needs

Help you create a detailed list of features and priorities for your ideal home (e.g., location, number of bedrooms, school district, style, etc.).

Search Efficiently

Use local MLS tools and market knowledge to find homes that meet your criteria.

Focus on your preferred neighborhoods, price range, and must-have features.

Preview & Filter Listings

Pre-screen properties to eliminate homes that are overpriced, poorly maintained, or not a good fit.

Save you time by only showing homes worth your consideration.

Provide Expert Guidance

Present the best-matched homes based on your needs and budget.

Offer insights into market conditions, pricing, and offer strategies.

Advocate & Negotiate

Represent your interests during showings, negotiations, inspections, and closing.

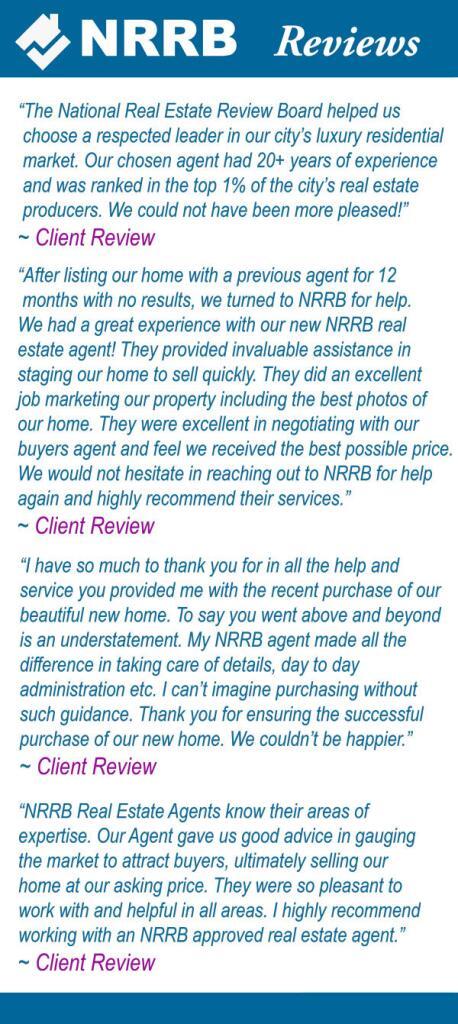

Proudly Helping Homeowners

Since 2009

NRRB – The National Standard

In Trusted Real Estate

Powered By Principles